Reports

Digital Asset Market - Q3 Review

Reports

Digital Asset Market - Q3 Review

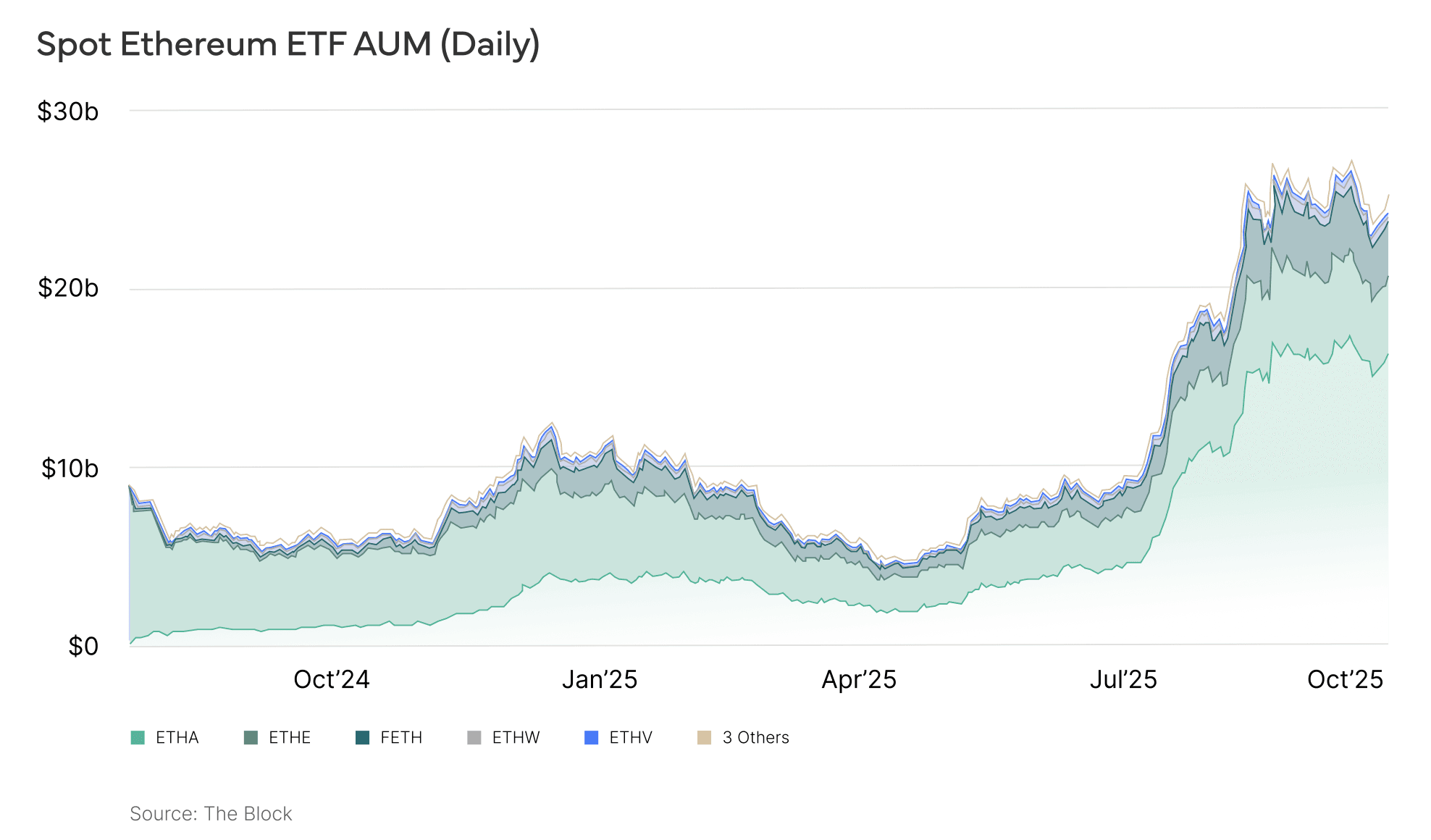

The second half of the quarter put a modest dent in what remains a longer-term uptrend for digital asset values broadly. Bitcoin retraced around 8% from its August highs and ETH roughly 12.5%. After a spectacular post-“Liberation Day” rally — with Bitcoin up 63% and ETH 243% — some profit-taking was inevitable. On the Bitcoin side, the drawdown appeared largely driven by concentrated crypto whale sell-offs, rather than a shift in broader market sentiment. For ETH, we continue to see growing institutional interest, particularly through ETFs, which attracted consistent net inflows throughout the quarter.

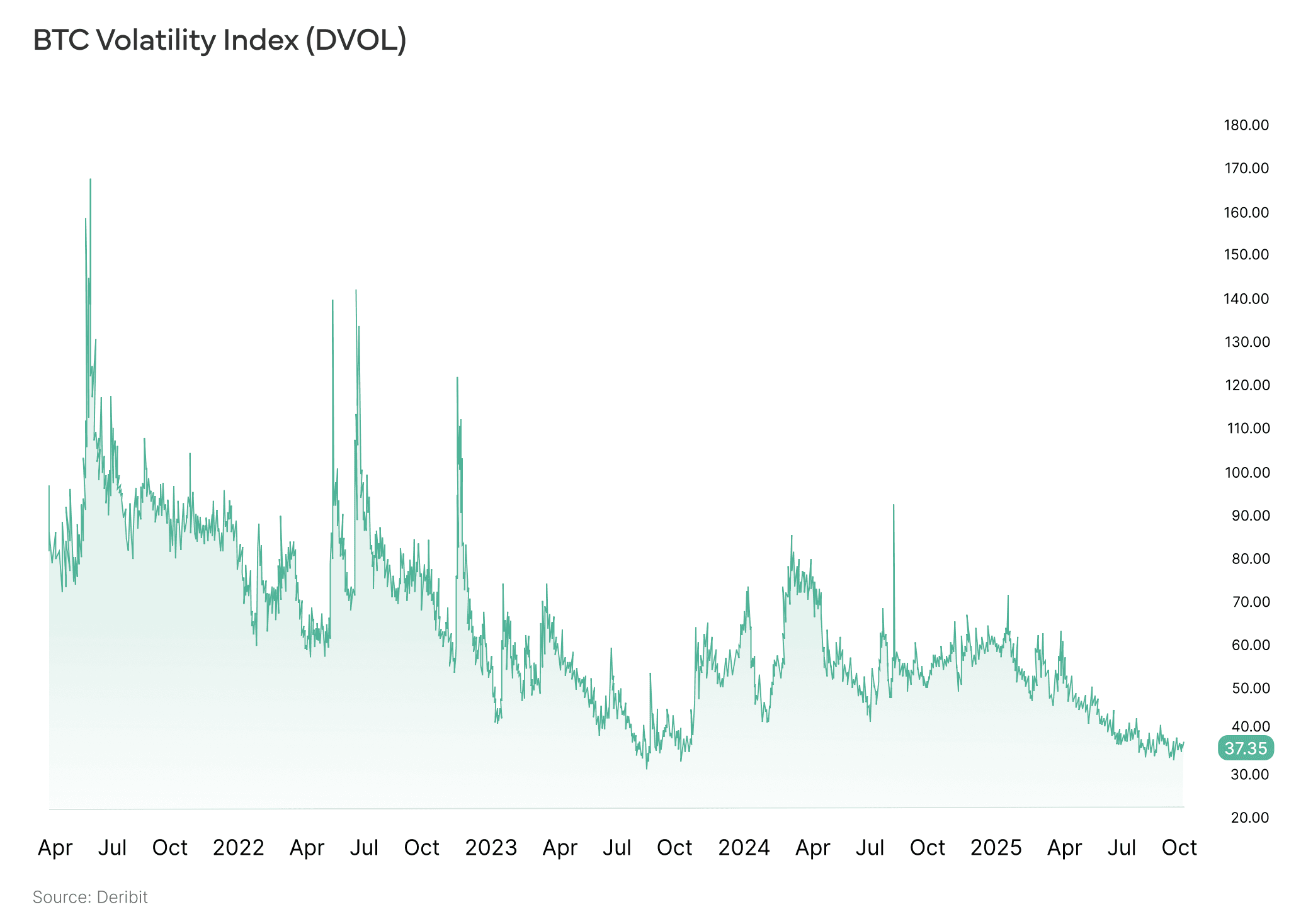

Volumes in spot and futures markets eased towards quarter-end but remained well above seasonal norms. In options, demand for risk reversals has picked up amid record-low implied volatility. Option selling, especially on the call side, has seemed to emerge as the consensus trade. Taken together, we believe the data reflects cautious optimism and a secular upward trend that remains intact despite recent pullbacks.

On the regulatory front, the transatlantic rift continues: the U.S. is pressing forward with a new regulatory outlook driving crypto adoption while the European Union pursues stricter licensing and supervisory frameworks. In the U.S., the GENIUS Act established a federal framework for stablecoins, requiring them to be fully backed by safe assets and introducing oversight that has bolstered legitimacy and investor confidence. Stablecoin issuance has risen sharply since its passage. Regulators have also clarified that certain liquid-staking designs may not qualify as securities and issued a no-action letter allowing state-chartered trusts to act as digital-asset custodians, expanding custody options beyond banks. In the UAE, Q3 saw updated licensing and oversight requirements for tokens and custodians, while globally, more than 99 jurisdictions are moving toward adoption of the FATF Travel Rule and VASP identity frameworks.

Risk assets more broadly delivered another strong quarter. U.S. equities extended their rebound on the back of a robust earnings season, expectations of a more dovish Fed, and continued enthusiasm around AI, while the more trade-sensitive European markets posted only modest gains. Encouragingly, the rally has broadened beyond U.S. mega-caps to small caps and emerging markets, with EM equities recording their second-best year-to-date performance since MSCI began tracking in 1998. That said, we believe markets may be underestimating several risks: a cooling labor market, the secondary effects of a U.S. government shutdown, persistent core inflation, stretched valuations in the tech sector, rising trade frictions, and political pressure on Fed independence.

September extended the positive momentum of recent months. U.S. equities posted their strongest September in more than 15 years, with technology once again at the forefront. The Nasdaq Composite gained 5.6% month-on-month, lifting quarterly returns to 11.2%, while the S&P 500 advanced 7.3% in Q3. As in prior months, tech and communications were the main drivers, whereas defensive sectors such as healthcare and consumer staples lagged. Google has gained a whopping 38% over the quarter, while AI bellwether NVIDIA has returned 18%. Encouragingly, the rally is beginning to broaden: small caps reached a new all-time high in September, surpassing their November 2021 peak, and the S&P 500 equal-weighted index also hit record levels. Unlike the stretched valuations of mega-caps, U.S. small caps remain closer to long-term averages, in some cases even below pre-Covid levels. The broader U.S. market has now advanced for five consecutive months since the “Liberation Day” sell-off, supported by a strong earnings season, an improved earnings outlook, the Fed’s rate-cutting cycle, and persistent enthusiasm around AI-driven productivity gains.

Across the Atlantic, the rally was echoed, albeit at a slower pace. The Stoxx 600 gained 1.5% in September and ~3% over the quarter. A stronger euro and weaker Eurozone growth weighed on earnings expectations, which in turn pressured equity performance. Unlike the U.S., Europe remains heavily tied to global trade dynamics and tariff regimes, and it lacks the kind of compelling secular narrative that AI provides to American markets.

Meanwhile, emerging markets (EMs) are having a moment. Despite U.S. policy shifts on trade and tariffs that would normally weigh disproportionately on EMs, the record slide in the dollar has fueled equity and debt markets. The MSCI EM Index has delivered a remarkable 23.9% YTD gain, its second-best YTD returns since index inception.

In fixed income, September’s U.S. federal funds rate cut came as little surprise after Fed Chair Jerome Powell hinted at such a move during his Jackson Hole speech. The quarter-point cut to 4.00–4.25% was the first after a nine-month pause, as the Fed assessed the impact of newly-imposed U.S. tariffs on growth and inflation. The move followed a weak U.S. jobs report, which showed only 22,000 jobs added in August. The Fed’s dot plot now points to two further cuts in Q4 and one more in 2026. Bond markets initially rallied, but momentum has faded.

After touching 4%, 10-year yields have risen again over the past three weeks as concerns grow over the inflationary effect of tariffs and the fiscal implications of the U.S. Congress’ “big beautiful bill”. Questions around the Fed’s independence persist, even after the Supreme Court’s recent decision preventing the president from immediately dismissing Federal Reserve Governor Lisa Cook. The government shutdown, with the risk of hundreds of thousands of federal employees being furloughed or even laid off, further complicates the Fed’s task. Adding to the challenge, the shutdown also means that U.S. NFP (non-farm payrolls) and other key economic data releases will be postponed, limiting the Fed’s ability to assess conditions.

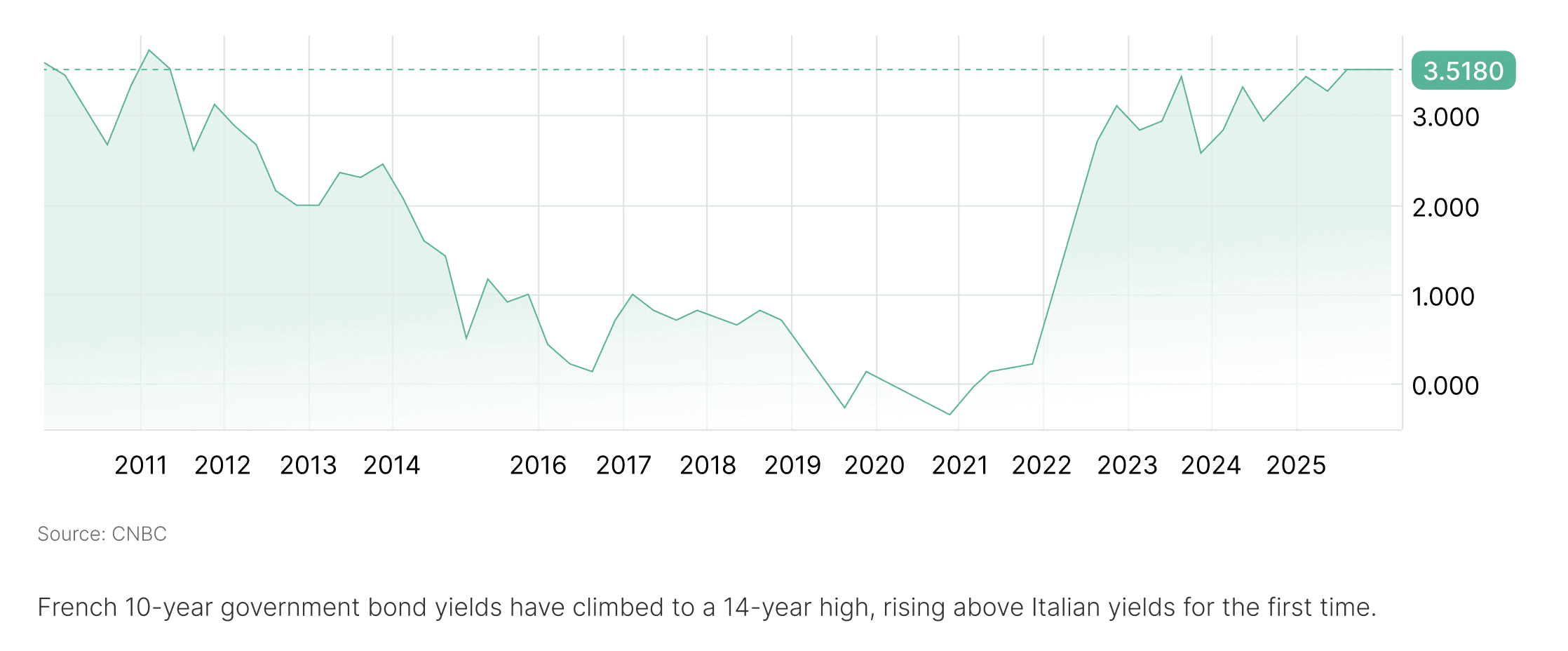

Meanwhile, the UK’s weak economic outlook is straining public finances and further narrowing the chancellor’s room for manoeuvre, with gilt yields climbing to 4.7%. In France, the collapse of yet another government has pushed borrowing costs to their highest level since 2011 and, for the first time, above those of Italy.

Summarizing and looking ahead, there are encouraging signals for risk assets: easing monetary policy, a rally extending beyond mega-caps, resilient U.S. retail sales, and an improving earnings outlook. Yet risks remain skewed to the downside. Despite improvement on the producer side, CPI inflation could remain sticky, limiting the Fed’s room for maneuver just as labor markets soften. Valuations, particularly in U.S. tech, are well above long-term averages, leaving the market vulnerable to sharp corrections. The AI secular growth narrative could lose momentum, and tariff tensions may worsen, hurting the bottom line for trade sensitive sectors on both sides of the Atlantic. Meanwhile, subdued European growth and mounting fiscal pressures—especially in France and the UK—could temper investor enthusiasm for the region’s 2025 rally. For equities, monetary easing is a tailwind, but a sustainable rally requires a credible growth trajectory. While Q2 GDP growth was flattered by tariff dynamics, Q3 will be the litmus test of the economy’s underlying strength.

As highlighted in our last update, these concerns—alongside questions about Fed independence—have been reflected in a higher gold price (up 28% YTD) and a weaker US dollar (-10% YTD). Equities, however, appear largely unbothered by these warning signs, at least for now.

After a weak August, historically a soft month for crypto, September brought cautious optimism. Bitcoin gained ~5.2% during the month, taking Q3 returns to 6.3%, though it stopped short of fresh all-time highs. Ethereum, still the flagship layer-1 protocol, dipped slightly in September (-1.3%) but delivered an extraordinary ~67% quarterly gain — one of its strongest quarters on record. We believe the recent pause looks more like profit-taking than a shift in sentiment. Market metrics across spot trading, derivatives, on-chain activity, DeFi TVL, and ETF flows all suggest a cooling yet healthy backdrop. Spot and futures volumes, open interest, and perpetual funding rates declined modestly, pointing to reduced speculative long positioning. Yet the annualized basis for BTC futures on Binance has climbed to its highest level since January.

by October 1. Solana ETFs — a proxy for mainstream appetite beyond BTC and ETH — have drawn steady inflows since launching in July, but AUM remains modest at ~$350mn. XRP ETFs, launched mid-September, have gathered ~$140mn.

Options markets continue to expand: Bitcoin option open interest hit new highs in September, even as trading volumes eased. Implied volatility has trended lower since January, with the Deribit DVOL index near historic lows — a sign of complacency and dominance of option sellers, especially on the call side. ETH shows a similar pattern, though with implied vol still above BTC levels. Skew metrics suggest a mildly cautious bias, with puts priced richer than calls.

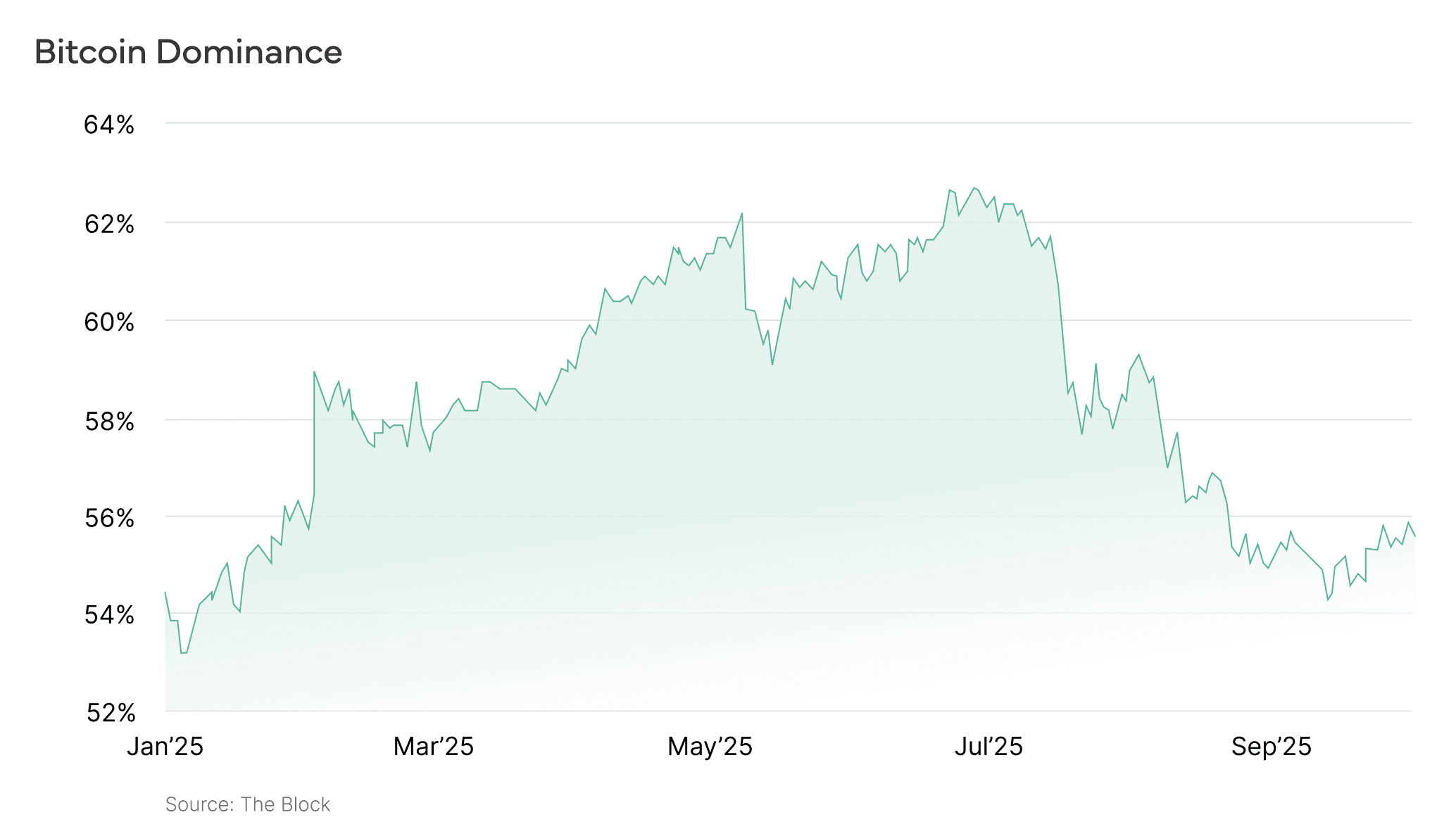

Crucially, breadth has improved. Signs of an “altcoin season” emerged in Q3, with sector-level gains more evenly-spread. Bitcoin dominance has dropped from 62% to 54%, its lowest since January. The launch of SOL, DOGE, and XRP ETFs has broadened institutional access, while Ethereum is increasingly framed as an infrastructure play attracting growing institutional flows.

On the regulatory front, the U.S. has taken several constructive steps. Following the July adoption of the GENIUS Act — introducing a federal licensing regime for stablecoin issuers — circulating stablecoin supply rose 16% to ~$290bn (per Grayscale). This stance contrasts sharply with Europe, where Bundesbank president Joachim Nagel questioned the policy implications of a stablecoin-dominated economy, and the ESRB and ECB warned about “multi-issuer” schemes. MiCAR is rolling out, with licenses now being granted to stablecoin issuers and CASPs, creating a clear regulatory divide: lighter, interpretive frameworks in the U.S. versus stricter licensing and supervision in Europe. Reinforcing the U.S. approach, the CFTC and SEC announced “Project Crypto,” allowing spot crypto assets to trade on CFTC-registered futures exchanges. The SEC also clarified that certain liquid-staking arrangements may not qualify as securities, and issued a no-action letter expanding custody eligibility to state-chartered trusts — a meaningful step for firms like Coinbase and Kraken.

The positive regulatory mood spilled into capital markets. Several high-profile crypto IPOs were heavily oversubscribed. Bullish was more than 20x oversubscribed, while Gemini — despite reputational headwinds from its Genesis ties — raised ~$425mn and saw a strong first-day pop. Figure, a blockchain-based lending and tokenization company, raised ~$787mn at a ~$5.3bn valuation, with shares jumping ~24% on debut. Other names reportedly preparing IPOs include Kraken, Grayscale, BitGo, and Anchorage.

Finally, Digital Asset Treasury (DAT) strategies are gaining traction. Pioneered by MicroStrategy, the model of corporates holding crypto reserves is spreading, with some firms even adding smaller assets like Litecoin. While we remain cautious on DATs as a sustainable driver of valuations, treasuries now collectively hold ~$128bn in crypto, of which Bitcoin accounts for ~86%. Their growing presence is becoming a structural factor in market dynamics.

Amid the broadening rally, Bitcoin’s dominance has fallen to its lowest level since January.

The Deribit DVOL index is hovering around its historical lows, possibly hinting towards some complacency in the options market.

After a rocky launch in July 2024, ETH ETFs have tripled in assets over Q3, surpassing the USD 25 bn mark on the back of both net inflows and strong ETH performance.

Digital assets ended September largely flat, but the broader rally appears intact, with recent moves looking more like a breather than a reversal. After a 63% run-up in Bitcoin and a 243% return in ETH, some profit-taking was inevitable. Overall, the mild sell-off was driven mainly by concentrated whale selling, rather than a broader shift in sentiment.

The overall rotation within digital assets highlights the broadening of the rally beyond Bitcoin, with market breadth at its strongest in years and bitcoin dominance at its lowest point in 8 months. Combined with supportive U.S. regulatory steps — from the GENIUS Act to clearer staking and custody guidance — and the prospect of a more dovish Fed, the setup for digital assets into year-end looks constructive, barring a major macro shock.

Investment advisory and asset management services are provided by Lionsoul Global Advisors LLC (“Lionsoul Global Advisors”), an investment adviser registered with the Texas State Securities Board (CRD #: 324883). Information presented, displayed, or otherwise provided is for educational purposes only and should not be construed as investment, legal, or tax advice, or an offer to sell or a solicitation of an offer to buy any interests in a fund or other investment product. Access to the products and services of Lionsoul Global Advisors is subject to eligibility requirements and the definitive terms of documents between potential clients and Lionsoul Global Advisors, as they may be amended from time to time.