Reports

Digital Asset Market - November in Review

Reports

Digital Asset Market - November in Review

November marked a difficult month for digital assets. Following October’s unprecedented liquidation cascade, many investors had expected a swift recovery on the basis that the drawdown was driven more by market-structure fragilities than by fundamental deterioration. Instead, sentiment remained fragile and forced selling continued. Bitcoin fell to its lowest level since April, erasing its year-to-date gains, and most altcoins suffered even deeper declines. Total crypto market capitalisation briefly slipped below USD 3 trillion – its lowest point since May – as liquidity remained thin and participants reduced leverage across venues. Towards the second part of the month – propelled by the market’s anticipation of a December rate cut – crypto markets partially recovered.

Equities, by contrast, traced a very different trajectory. After the sharp sell-off that immediately followed the October 10 tariff announcement, global equity markets recovered decisively in the subsequent weeks, with major US and European indices pushing to fresh all-time highs, volatility collapsing, and credit spreads tightening to multi-year lows. However, that resilience did not fully carry into November. As stretched valuations in AI-linked equities became a source of renewed concern, risk appetite moderated and market leadership narrowed.

November unfolded in two distinct phases: a risk-averse first half followed by a more constructive tone later in the month. While equities had recovered impressively from the October 10 tariff shock – pushing major US and European indices to new all-time highs – the narrative turned more complicated in November as sentiment softened and leadership narrowed.

With US macro data releases limited during the government shutdown, corporate earnings effectively became the primary macro signal. The Q3 reporting season has been strong: the S&P 500 is tracking roughly 14% year-over-year earnings growth, the fastest pace in nearly four years. AI-related companies again led the expansion (around 24% YoY), as beneficiaries of the data-centre buildout continued to exceed expectations and raise guidance. Outside AI, financials and healthcare delivered the most consistent strength.

In Europe, earnings once again lagged the US but still surpassed subdued expectations. Luxury goods, supported by Chinese stabilization and firm pricing power, were the clear outperformers. With most Stoxx 600 companies reported, headline earnings appear only slightly negative (around –1%), reflecting a challenging macro backdrop but also resilient execution. Emerging Markets broadly mirrored the US, posting ca.12% year-over-year earnings growth despite recent drawdowns and continue to track a strong full-year outcome.

Nvidia – the bellwether of the AI cycle – reported another strong earnings beat with positive forward guidance. Given its centrality to the AI buildout, some commentators dubbed it the “most important earnings release of all time.” Yet despite exceptional numbers, the stock initially sold off and briefly pushed the VIX to its highest level since April. While rising receivables raised some questions about customer financing capacity, we believe the reaction was driven more by crowded positioning and elevated expectations already embedded in the price. The episode highlighted how dependent broader market sentiment has become on a single thematic narrative – and how challenging it may be for AI-linked companies to maintain momentum amid growing capex fatigue. A notable pattern this season was asymmetric price reactions: companies missing expectations saw unusually sharp drawdowns, while even substantial beats did not reliably drive rallies.

The AI narrative also spilled decisively into fixed income markets. Recent weeks have seen a surge in bond issuance from large tech firms and hyperscalers to finance AI-driven data-centre expansion. More defensive sectors such as utilities have announced multi-billion, multi-year capex programmes to meet the expected surge in energy demand. This has resulted in large volumes of new IG issuance, particularly long-dated tenors (10–30 years), as utilities align maturities with infrastructure buildout timelines.

Credit analysts note that this AI-capex financing wave is beginning to reshape the composition of the corporate bond universe, with technology and infrastructure-heavy issuers representing a growing share of supply at the expense of more traditional industrial borrowers. While demand for high-quality AI-capex bonds remains strong – especially from long-duration buyers such as insurers and pension funds – the rising supply has begun pushing spreads wider. Several major tech firms have seen credit spreads and CDS levels drift higher as investors grow more cautious. Oracle’s bonds, for example, sold off following reports that the company may issue an additional US$38 billion of debt to fund AI infrastructure – on top of an already substantial existing debt load. This underscores the point that if returns on AI capex lag today’s elevated expectations, credit fundamentals could come under pressure, with potential spillover effects across broader credit markets.

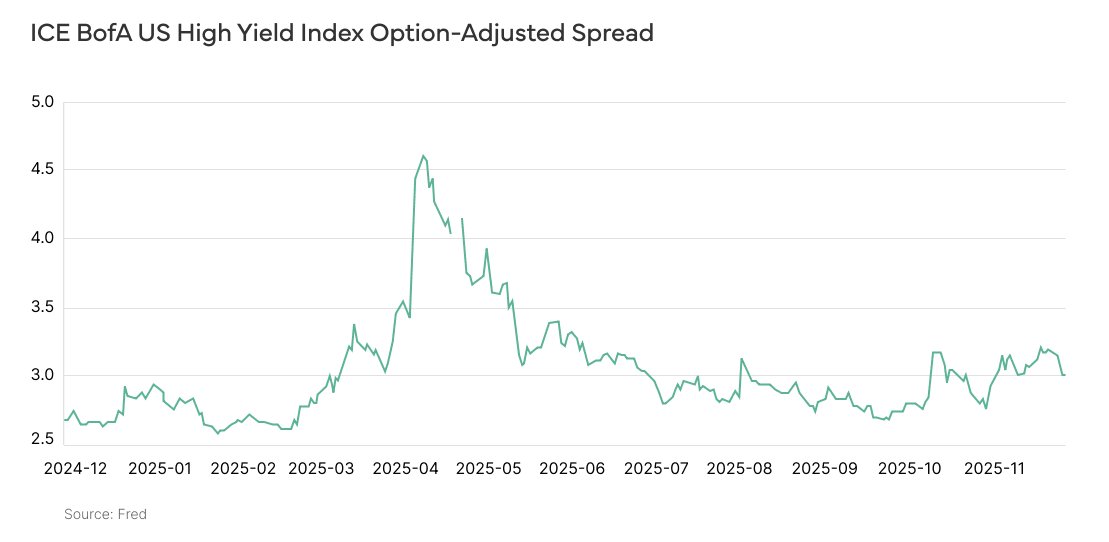

Overall, credit spreads remain tight by historical standards, supported by solid fundamentals and strong demand for yield. Nonetheless, spreads have widened modestly in recent weeks – particularly in high yield and lower-quality credit – amid signs of increased supply and isolated credit concerns. The weakest segment (CCC / deeply speculative) has already shown more pronounced stress, and several idiosyncratic credit events (e.g., First Brands, Tricolor) have further sharpened investor scrutiny across private credit and high yield.

On the policy front, the US federal government shutdown ended on 12 November, after Congress approved a stop-gap funding bill. At 43 days, it was the longest shutdown in US history. The bill represented a narrow compromise: it prioritised reopening government and restoring core services rather than addressing politically sensitive issues such as healthcare subsidies. Funding is secured only for the short term, meaning another standoff could emerge in January absent a broader agreement.

One of the main drivers of November’s volatility was the shifting interpretation of Federal Reserve policy. Although the Fed cut rates in October and ended quantitative tightening, its post-meeting communication struck a more hawkish tone, leading investors to reassess the likelihood of a December cut. With labour markets showing signs of softening but inflation remaining sticky, the possibility of a stagflation-style scenario briefly gained traction, constraining the Fed’s policy flexibility. Initially, markets assumed the Fed would remain on hold for the rest of the year. Late in the month, however, another weak labour report and dovish comments from NY Fed President (and FOMC Vice Chair) John Williams reignited expectations of a December cut – triggering a relief rally across equities.

Despite a small pickup since October, credit spreads in the US high yield sector remain close to their historical lows.

Digital assets continued to trade as high-beta macro assets in November, closely tracking shifts in global risk sentiment and Federal Reserve expectations. As with equities, markets became more sensitive to stagflation-risk narratives: sticky inflation paired with softer labour data produced several days of sharp intraday swings. While the macro backdrop remained the dominant driver, idiosyncratic crypto-specific developments – ETF flows, regulatory headlines, and ecosystem rotation – played a role in shaping performance.

Bitcoin and Ethereum both saw substantial drawdowns, with BTC declining roughly 10% and ETH falling materially more, around 20–25%. Higher-beta tokens underperformed even more sharply, consistent with a risk-off to neutral market regime in which capital consolidates into higher-quality assets rather than rotating down the risk curve.

ETF flows reinforced this dynamic: BTC and ETH spot ETFs recorded net outflows over the month, reflecting de-risking by tactical allocators and reduced retail participation. Notably, November did not witness the kind of “buy-the-dip” retail inflows that characterised past drawdowns in 2025. BTC dominance remained broadly stable, underscoring that capital retreat was defensive rather than rotational.

From a technical standpoint, Bitcoin ended November in a “wait-and-see” posture. The early-month breakdown through several key support levels forced a reassessment of risk, but the subsequent rebound off falling-wedge support offered tentative signs of base formation. The technical pivot remains clear:

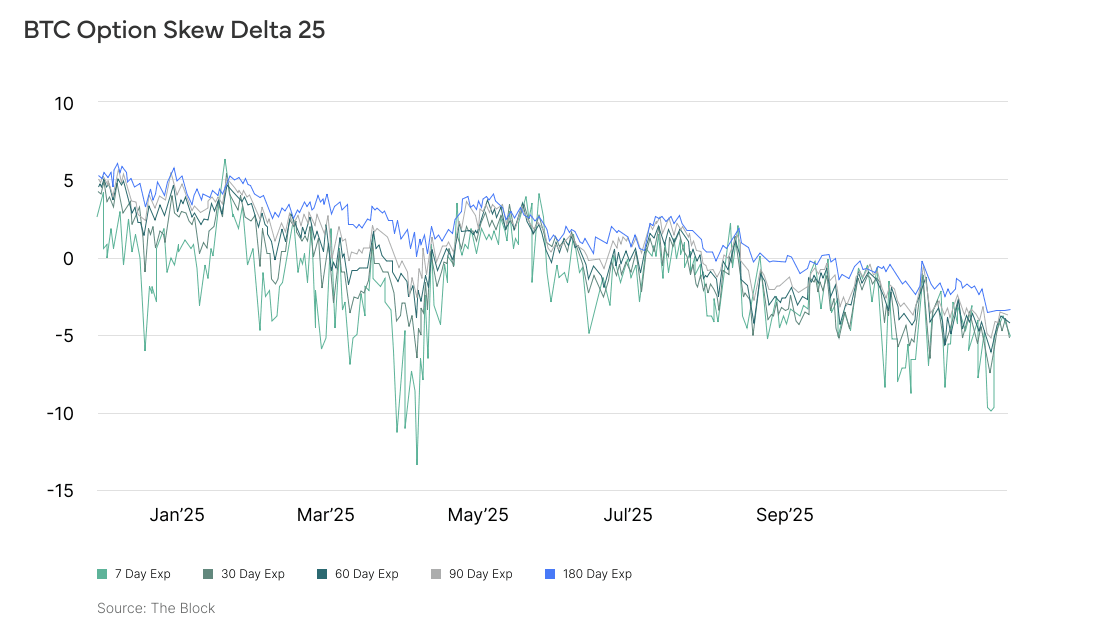

Funding rates remained negative, leverage stayed low, and the market displayed no signs of systemic stress or widespread forced deleveraging. Implied volatility spiked mid-month – partly catalysed by Nvidia-driven equity volatility – before retreating into month-end. The Deribit BTC DVOL index reached its highest intra-month reading since April, and options skew showed a persistent preference for downside protection, reflecting cautious near-term sentiment. A growing trend has been the increased use of options overlays – both for yield and volatility management – as institutional allocators continue to integrate derivatives into crypto cash-flow strategies. Aggregate open interest and trading volumes for BTC options remains close to all-time highs.

On-chain liquidity conditions were broadly neutral. Centralized exchange liquidity improved modestly, while decentralized exchange depth remained stable across L2s, despite muted trading activity. A notable feature was the improvement in stablecoin supply, particularly USDC, which expanded mid month – a constructive indicator of capital inflows and risk-taking capacity.

November saw a sharp divergence across crypto sectors: AI-adjacent protocols (compute, storage, data marketplaces) benefited from the broader AI-capex narrative in equities, showing relative strength but was still down significantly month- over-month. L2 ecosystems underperformed due to declining fee revenues and reduced speculative activity but saw renewed flows late in November alongside the broader rally. DeFi remained in consolidation mode with stable but unspectacular activity. Overall TVL remains approximately 27% below its October highs.

Regulatory news was relatively muted but tilted positively: In the US, the resolution of the government shutdown reduced macro uncertainty and revived timelines for pending rulemaking processes. In Europe, continued progress on MiCA secondary legislation provided incremental clarity, particularly around custody and staking definitions. Several Asian jurisdictions signalled renewed interest in exchange oversight and custody regulation, though without major near-term implications.

25-delta option skew is trading near its lowest levels across maturities since the tariff-induced sell-off in April, signalling a clear preference for downside hedging over upside participation.

The violent fallout from October 10 continued to cast a long shadow over digital asset markets in November. While some investors initially hoped for a rapid rebound – mirroring the swift recovery seen in equities – the underlying sentiment remained fragile. The second half of November did bring pockets of optimism as macro conditions improved, but from a technical perspective it remains too early to conclude that the market has decisively turned the corner. The coming weeks will be crucial in determining whether the October 10 episode becomes a contained, idiosyncratic shock that the market can fully move past, or whether it marks the start of a more prolonged downturn.

On a more constructive note, systemic leverage has been substantially reduced, and trading infrastructure across both centralized and decentralized venues has become more conservative and better risk-managed. These developments significantly lower the probability of seeing a repeat of the extreme dislocation observed on October 10. However, until key technical levels are reclaimed and flows stabilize, caution remains warranted.

Investment advisory and asset management services are provided by Lionsoul Global Advisors LLC (“Lionsoul Global Advisors”), an investment adviser registered with the Texas State Securities Board (CRD #: 324883). Information presented, displayed, or otherwise provided is for educational purposes only and should not be construed as investment, legal, or tax advice, or an offer to sell or a solicitation of an offer to buy any interests in a fund or other investment product. Access to the products and services of Lionsoul Global Advisors is subject to eligibility requirements and the definitive terms of documents between potential clients and Lionsoul Global Advisors, as they may be amended from time to time.