Reports

Digital Asset Market - 2025 in Review

Reports

Digital Asset Market - 2025 in Review

Digital assets ended a difficult year on a weak note. While the bulk of the selling pressure was absorbed during October and November, December failed to materially shift the narrative for the quarter, despite signs of stabilisation in crypto markets. Q4 closed with a clear macro-overhang tone, with digital asset prices exhibiting heightened sensitivity to interest rates and inflation expectations.

Bitcoin and Ethereum recorded modest losses in December (-3.2% and -2.0%, respectively). However, on a quarterly basis, Bitcoin declined by approximately 23%, marking its weakest quarter since Q2 2022. This sharp reversal contrasted with strong performance earlier in the year and underscored the cyclical nature of digital asset markets.

While it may be premature to call a definitive bottom, market dynamics suggest that crypto assets have stabilised for now. Exchange volumes have declined in recent weeks and liquidity conditions remain thinner than pre-October levels. That said, funding rates – while still below historical averages – have begun to rise, signalling a modest improvement in sentiment across derivatives markets. In options markets, open interest, trading volumes, and implied volatility have trended lower since early October. Although option skew continues to favour puts, a gradual shift toward a more symmetrical volatility smile since December suggests reduced demand for downside protection.

From a technical perspective, price action remains largely range-bound. Bitcoin spent most of December trading within a broad consolidation range of approximately USD 86,000-95,000 following the late-2025 correction, indicating a temporary equilibrium between supply and demand. Repeated rebounds above the USD 88,000–90,000 area point to near-term support, though upside momentum remains subdued in the absence of a clear catalyst. Some short-term indicators point to renewed buying interest as prices reclaim key moving averages, but a decisive break above the USD 94,000-100,000 resistance zone would be required to signal a meaningful reversal of the prior downtrend.

Stepping back, 2025 proved to be a volatile and bifurcated year for digital assets. Strong upside earlier in the cycle gave way to a pronounced correction in the final quarter, leaving full-year returns mixed to modestly negative for major assets. At the same time, the year marked continued progress in the maturation of the asset class, with investors becoming increasingly selective and focused on liquidity, operational robustness, and risk discipline rather than broad, directional exposure.

Macro & Market Backdrop: A Weak Finish to a Strong Year

December marked an uninspiring end to an otherwise strong year for global equity markets. The S&P 500 traded largely flat during the month (-0.1%), but closed the quarter up 2.3% and finished the year with a solid 16.4% gain. Continued leadership from big-tech and AI-related growth stocks remained a defining feature of 2025, with the tech-heavy Nasdaq-100 posting returns of 20.2%, materially outperforming the broader U.S. equity market.

European equities also posted a strong year. While the Euro Stoxx 50 traded broadly flat in December, it delivered an impressive 21.8% return for the year, outpacing many U.S. benchmarks. Eurozone equities – and German equities in particular – benefited from cyclical recovery expectations and valuation catch-up relative to the U.S. market. Emerging market equities delivered exceptionally strong performance in 2025. Supported by elevated commodity prices, a weaker U.S. dollar, and selective exposure to AI-related themes (notably semiconductors), the MSCI Emerging Markets Index rose 33.6%, marking its best year since 2017 and one of the strongest annual performances on record.

Despite the strong performance across equity markets, all major asset classes were eclipsed by gold, which surged by more than 60% over the year. The historic rally – driven by a weaker U.S. dollar, rising concerns around Federal Reserve independence, expectations of monetary easing, and heightened geopolitical uncertainty – represented gold’s strongest annual gain since 1979.

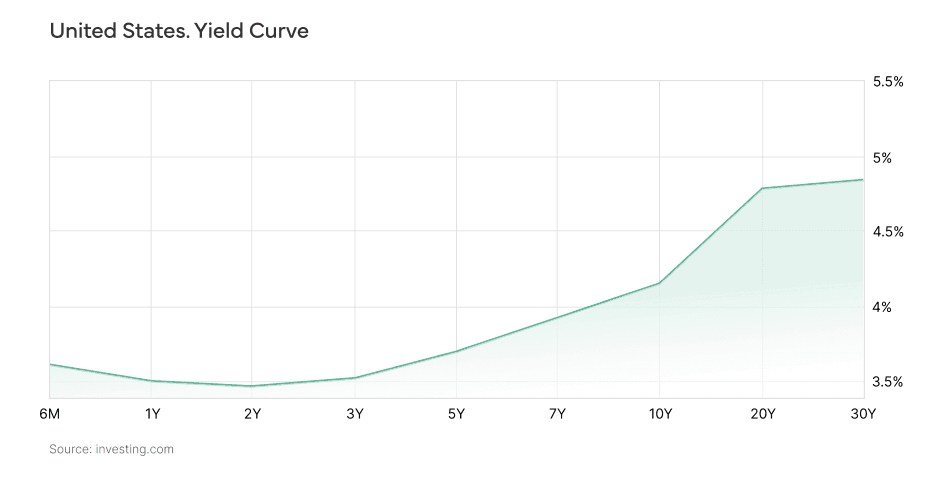

On the fixed income side, sovereign bond markets remained volatile throughout 2025, with yields oscillating in response to shifting inflation expectations, fiscal concerns, and central bank signalling. Despite intermittent expectations of rate cuts during the year, long-dated yields remained structurally elevated, reinforcing the “higher-for-longer” narrative. U.S. Treasury yields ended the year modestly lower, but total returns were constrained by persistent term premia and mounting concerns around fiscal sustainability, particularly in light of elevated issuance needs. European sovereign bond markets faced renewed fiscal scrutiny, culminating in heightened volatility across both peripheral and core markets. France emerged as a notable stress point late in the year, as political uncertainty and concerns over fiscal slippage triggered a sharp repricing of French government bonds, widening spreads versus Germany and reviving broader questions around Eurozone fiscal discipline and debt sustainability.

Credit markets delivered a solid performance in 2025, supported by strong corporate balance sheets and historically low default rates. However, spreads offered limited compensation for duration and liquidity risk for much of the year. Towards year-end, isolated stress events began to surface in the U.S. credit market (e.g. First Brands, TriColor), though these episodes currently appear idiosyncratic rather than indicative of a broader systemic trend.

Looking back, 2025 proved to be a tumultuous year despite very strong headline returns. One of the most significant events was the April “Liberation Day” tariff announcement, which sent shockwaves through global markets and triggered a sharp sell-off across risk assets. At the time, only the most optimistic investors would have expected markets to close the year near all-time highs. The subsequent rally was driven by several factors: implemented tariffs ultimately proved significantly lower than initially feared (“TACO trade”), while the global economy and the U.S. economy in particular, demonstrated far greater resilience than anticipated. Strong corporate earnings carried much of the burden for U.S. equities, while AI emerged as one of the most powerful secular growth narratives of the past 25 years, underpinned by expectations of substantial productivity gains.

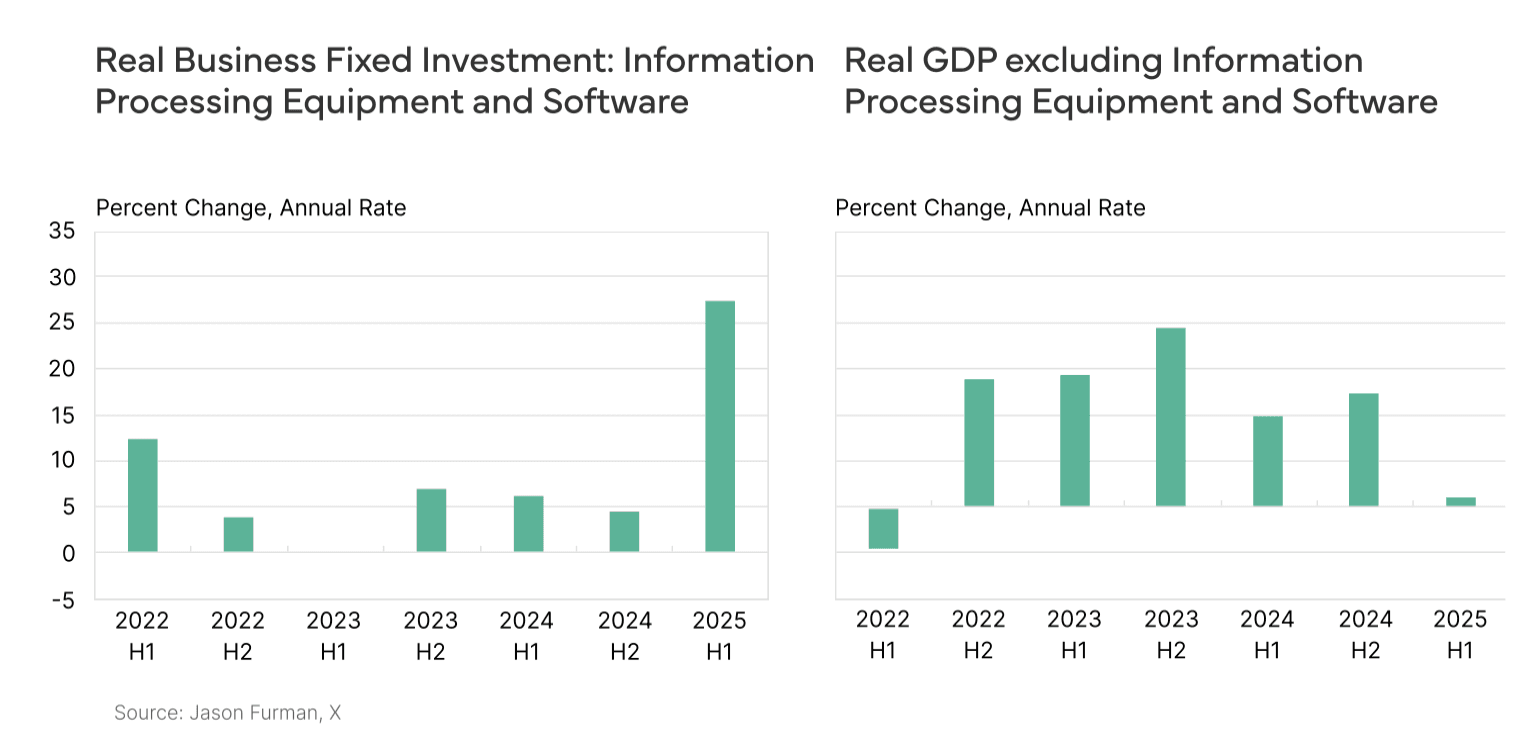

Importantly, the impact of AI on markets has extended beyond expectations alone. The associated surge in capital expenditure has become a meaningful macroeconomic driver. Whereas previous technology cycles were characterised by capex-light, software-centric business models, the current AI cycle more closely resembles historic infrastructure build-outs, such as the fibre-optic boom of the late 1990s or the railway expansion of the 19th century. According to economist Jason Furman, U.S. GDP growth in the first half of 2025 was almost entirely driven by investment in data centres and information- processing technology.

Looking ahead to 2026, the majority of major investment banks remain constructive. The average sell-side forecast expects the S&P 500 to rise by 9.2%, with a median forecast of 8.7%. Most strategists describe the environment as a late-cycle uptrend, citing AI-driven capex and productivity gains, alongside accommodative fiscal and monetary policy, as key tailwinds for global markets. Continued leadership from technology and AI-linked sectors is widely expected, although broader market participation could emerge as an important upside catalyst for U.S. equities. Consensus expectations continue to centre around two to three interest-rate cuts.

Despite this broadly positive outlook, material risks remain. High concentration in AI-related themes and technology stocks, combined with U.S. growth increasingly reliant on AI-driven investment, leaves markets vulnerable to sharp corrections should confidence in the narrative falter. U.S. equity valuations, as measured by the Shiller CAPE ratio, are at their highest levels since the peak of the dot-com bubble and exceed those seen in 1929. European equities are generally viewed as more attractive from a valuation perspective, with upside linked to easing financial conditions and any improvement in industrial activity. However, fiscal sustainability concerns, most notably in parts of Southern Europe and France, remain a structural headwind that could limit multiple expansion. For emerging markets, consensus remains constructive, supported by lower real rates, a weaker U.S. dollar, and exposure to global manufacturing, commodities, and technology supply chains. China is viewed as a key swing factor as expectations stabilise but remain cautious.

Investment in data-processing equipment (e.g. data centres and related infrastructure) accounted for roughly 4% of U.S. GDP in the first half of 2025, yet contributed approximately 92% of overall GDP growth during the period. This highlights the outsized impact of AI-related capital expenditure – not only on capital markets, but also on real economic activity and measured output.

Despite intermittent expectations of rate cuts during the year, long-dated yields have remained structurally elevated, reinforcing the “higher-for-longer” narrative. This has been driven by persistently elevated term premia, lingering inflation expectations, and concerns around fiscal sustainability, particularly in the context of large U.S. budget deficits (approximately 6% of GDP in 2025).

Digital asset markets experienced a volatile and ultimately disappointing end to 2025, contrasting sharply with the strong performance of most traditional asset classes. After reaching new highs earlier in the year, crypto assets suffered a pronounced drawdown in the fourth quarter, leaving full-year returns mixed to negative for the largest assets and deeply negative for most of the altcoin market.

Bitcoin declined by approximately 3% in December and fell more than 20% over Q4, finishing the year down around 6%. Ethereum underperformed Bitcoin, declining more sharply into year-end and closing 2025 with a loss of roughly 11%. The late-year sell-off was broad-based and coincided with tightening financial conditions, rising real yields, and renewed macro uncertainty, reinforcing the view that digital assets continue to behave as high-beta risk assets during periods of stress.

A defining feature of 2025 was the increased macro sensitivity of crypto markets. Correlation with traditional risk assets rose meaningfully during risk-off episodes, particularly in Q4, as liquidation dynamics, funding stress, and positioning unwinds amplified price moves. Despite ongoing narratives around Bitcoin as a potential hedge or alternative store of value, market behaviour during periods of stress continued to resemble that of speculative growth assets rather than defensive allocations. The October 10 sell-off was one of the defining events in 2025. It marked one of the most violent dislocations in the history of digital assets. Triggered by the same U.S.–China tariff shock that equities quickly digested, over-leveraged crypto markets suffered a cascading liquidation that erased more than US $500 billion in market value within hours. Within a single day, more than $19 billion in leveraged positions (mostly long perpetual futures) were wiped out – the largest 24-hour liquidation event ever recorded in crypto markets. The scale of forced unwinds revealed structural weaknesses in centralised-exchange risk engines and the fragility of cross-margin systems.

Ethereum’s relative underperformance reflected ongoing uncertainty around value accrual and ecosystem monetisation, as well as competition from alternative smart-contract platforms. While staking yields and infrastructure adoption remain supportive long-term factors, shorter-term price action was dominated by broader risk sentiment rather than idiosyncratic fundamentals.

Importantly, price weakness in 2025 masked continued structural and institutional progress across the digital asset ecosystem. Regulatory clarity improved in several key jurisdictions, institutional access expanded via exchange-traded products and regulated custody solutions, and tokenisation and stablecoin use cases gained further traction. These developments reinforced the view that digital assets are continuing to mature as an asset class, even as near-term price dynamics remain cyclical and macro-driven.

Investor behaviour throughout the year became increasingly selective. Rather than broad beta exposure, capital gravitated toward strategies emphasising liquidity, counterparty risk management, yield sustainability, and operational robustness. The events of Q4 further underscored the importance of risk controls, particularly given the tendency for correlations to rise sharply during periods of market stress.

Regulation was one of the most important structural tailwinds for digital assets in 2025. The year marked a decisive shift from regulatory uncertainty toward clearer frameworks across major jurisdictions. In the U.S., the approval of additional spot ETFs such as Solana and XRP as well as the continued growth of spot Bitcoin and Ethereum ETFs significantly expanded institutional access and reinforced crypto’s integration into traditional capital markets under the oversight of the U.S. Securities and Exchange Commission. In Europe, the implementation of the Markets in Crypto-Assets Regulation (MiCA) provided a harmonised regulatory regime covering issuance, custody, and service provision, materially improving legal certainty for institutional participants. At the same time, progress around stablecoin frameworks – including clearer reserve, disclosure, and governance requirements – strengthened confidence in on-chain settlement and tokenised cash use cases. Collectively, these developments marked a turning point, with digital assets increasingly treated as a regulated financial asset class rather than a regulatory outlier.

Looking ahead to 2026, we remain constructive on a medium-term horizon, while acknowledging elevated volatility and macro sensitivity in the near term. Bitcoin is generally viewed as structurally supported by institutional adoption, constrained supply dynamics, and improved market infrastructure. However, its cyclical performance is expected to remain closely tied to global liquidity conditions, real interest rates, and broader risk sentiment.

Ethereum and other smart-contract platforms (most notably the layer-1 tokens) are increasingly framed as longer-duration assets, with upside linked to adoption, tokenisation, and real-economy use cases rather than pure price momentum. Volatility is expected to remain elevated, but institutional participation – particularly through regulated products and custody solutions – is seen as a potential stabilising force over time.

Regulatory focus is expected to shift from framework design to implementation, supervision, and enforcement. A key U.S. regulatory focus is the Digital Asset Market CLARITY Act, which passed the House with bipartisan support and is expected to progress in the Senate. The legislation aims to resolve long-standing regulatory uncertainty by clearly delineating oversight between the U.S. Securities and Exchange Commission and the U.S. Commodity Futures Trading Commission, providing clearer compliance pathways for crypto exchanges, brokers, and custodians. While not yet law, the CLARITY Act represents a meaningful step away from enforcement-led regulation toward a more predictable U.S. market structure, with potentially positive implications for institutional participation. Markets will closely watch the U.S. midterm elections, with a Democratic majority generally viewed as less supportive of crypto-friendly legislative progress. In Europe, MiCA implementation is expected to move into a more operational phase, with increased scrutiny on licensing, capital requirements, governance, and cross-border activity. Globally, further progress is anticipated around stablecoins, tokenised securities, and the treatment of staking and yield-generating activities, particularly as traditional financial institutions deepen their on-chain engagement. While regulatory risk has not disappeared, the direction of travel is increasingly toward greater clarity and institutional compatibility, reinforcing the longer-term case for adoption even as near-term market dynamics remain cyclical and macro-driven.

Overall, 2025 marked a transition year for digital assets: weaker price performance contrasted with continued progress in regulation, infrastructure, and institutional engagement. While digital assets remain vulnerable to macro shocks and liquidity- driven drawdowns, the underlying foundations of the asset class continue to strengthen, setting the stage for a more mature role within diversified portfolios.

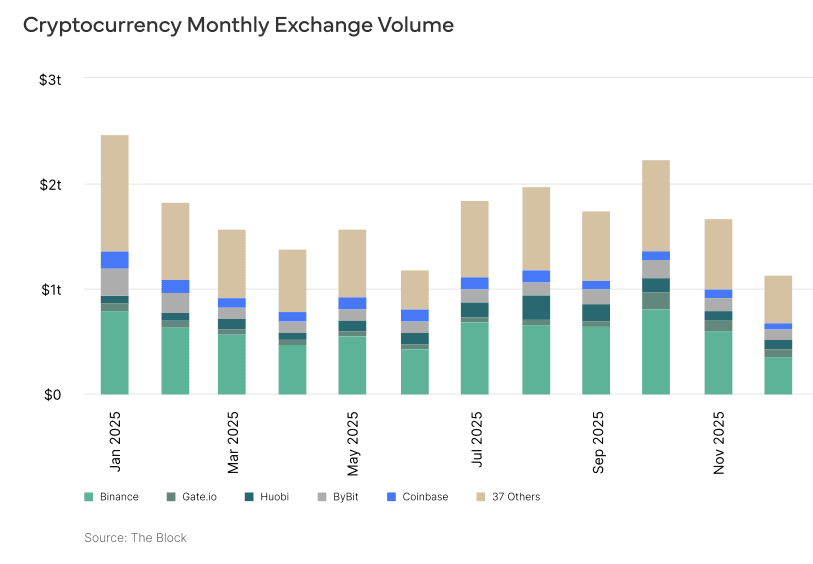

Since the October drawdown, trading volumes across CeFi venues have remained subdued, pointing to reduced market activity and thinner liquidity provision.

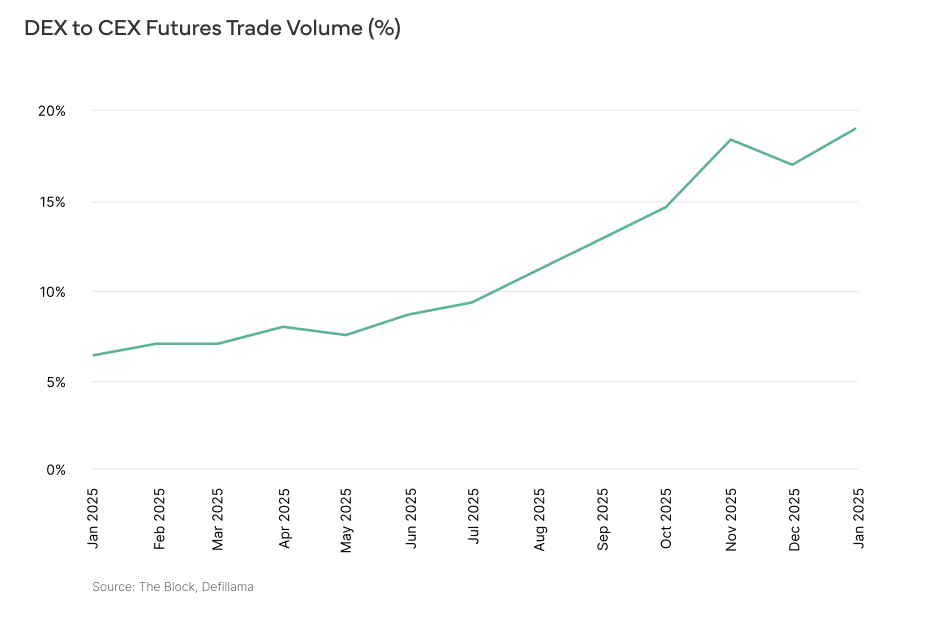

Overall, 2025 was a constructive year for DeFi markets. The October 10 liquidation event proved to be a defining stress test, reinforcing DeFi’s position as a relative winner in its ongoing competition with centralised exchanges. While several CeFi venues struggled with technical outages and liquidation bottlenecks, decentralised protocols remained largely resilient. Major DeFi platforms experienced materially fewer liquidations, no systemic API failures, and only limited pricing dislocations, supported by diversified and robust oracle data feeds. As of December 2025, DeFi’s share of total on-chain activity relative to centralised venues reached its highest level on record.